doi: 10.56294/mr202215

ORIGINAL

How do technology equipment companies implement new billing strategies?

¿Cómo implementan las empresas comercializadoras de equipos de tecnología nuevas estrategias de facturación?

Disney Hernández Tique1 ![]() *,

Jenny Judith Puentes Ordoñez1

*,

Jenny Judith Puentes Ordoñez1 ![]() *,

Carlos Alberto Gómez Cano2

*,

Carlos Alberto Gómez Cano2 ![]() *

*

1Universidad de la Amazonia. Florencia, Colombia.

2Corporación Unificada Nacional de Educación Superior – CUN. Florencia, Colombia.

Cite as: Hernández Tique D, Puentes Ordoñez JJ, Gómez Cano CA. How do technology equipment companies implement new billing strategies?. Metaverse Basic and Applied Research. 2022; 1:15. https://doi.org/10.56294/mr202215

Submitted: 17-10-2022 Revised: 14-11-2022 Accepted: 25-12-2022 Published: 26-12-2022

Editor: Lic.

Mabel Cecilia Bonardi ![]()

ABSTRACT

Objective: assess the implementation of electronic invoicing in technology equipment trading enterprises in Florencia Municipality, Caquetá.

Methods: the research approach is mixed, qualitative due to the implementation of 116 surveys and qualitative due to the development of two interviews with municipal actors from Florencia – Caquetá; likewise, the type of descriptive-explanatory research given to the goal of this piece of research was developed.

Results: 78 out of 116 business persons declared they had implemented the electronic invoicing system, where serious problems were found regarding training and teaching in the use of information and research technologies. In this sense, the interview stated there is resistance to change and a lack of flexibility in technology-related knowledge.

Conclusion: implementing electronic invoicing in technology equipment trading enterprises in Florencia Municipality is strengthening, considering that they have had different kinds of growth and development barriers due to costs and lack of training.

Keywords: Business; Technology; Electronic Bill.

RESUMEN

Objetivo: evaluar la implementación de la facturación electrónica en las empresas comercializadores de equipos de tecnología del municipio de Florencia, Caquetá.

Métodos: el enfoque de investigación es de carácter mixto, cualitativo debido a la implementación de 116 encuesta, y cualitativo debido al desarrollo de dos entrevistas a actores municipales de Florencia - Caquetá, de igual manera se desarrolló el tipo de investigación descriptiva-explicativa dado al objeto de la investigación.

Resultados: 78 de 116 empresarios manifestaron la implementación del sistema de facturación electrónica, en donde se hallaron serios problemas de capacitación y enseñanza en el uso de las tecnologías de información e investigación. En este sentido, los entrevistados manifiestan la resistencia al cambio y la falta de flexibilidad en el conocimiento relacionando a las tecnologías.

Conclusión: la implementación de la facturación electrónica en las empresas comercializadoras de equipos tecnológicos en el municipio de Florencia se encuentra en fortalecimiento, teniendo en cuenta que han tenido diferentes tipos de barreras de crecimiento y desarrollo debido a costos y falta de capacitación.

Palabras clave: Empresa; Tecnología; Factura Electrónica.

INTRODUCTION

Information and communication technologies (ICTs) have a strategic position in society, particularly in the economic sector, with an emphasis on the business area. Said technologies have increased their relevance according to the needs of society, all the more in a post-pandemic scenario. In this sense, ICTs are one of the fundamental pillars in current businesses due to the technological revolution, providing new opportunities to develop new business practices. However, unawareness and lack of efficient application in business management are among their disadvantages.(1)

According to the Global Report of the World Economic Forum (2015), Colombia is one of the first Latin American countries to surpass Mexico, Brazil and Argentina in the use and implementation of ICTs, not only in the educational sector but also in the business context, therefore making it possible to generate competitiveness and development in the production sector in the country.

Thus, ICTs have become a vital factor for the consolidation of enterprises since their implementation and use strongly impinges not only on the job environments but also on the daily activities of enterprises. For instance, ICTs are essential as regards the accounting aspects. This is because, nowadays, enterprises' main goal is to increase their profits by reducing their production, transportation and trading costs.(2)

For the enterprises of the new century, ICTs are the main source of information and the resource for decision-making. Therefore, applying ICTs in small and medium-sized enterprises increases their productivity, yield and possibilities of success. Enterprises have found a new way to do business worldwide, regardless of whether the enterprise is physical or virtual. A briefcase of this is mobile telephony: when there was no such alternative, communications with suppliers and clients had to be provided via postal services.(3,4)

After taking away productivity from the organization, the Internet is now an efficient tool for advertising, and e-commerce is a new way of selling, allowing the development of new business models.(5,6)

This study aimed to assess the implementation of electronic invoicing in the technology equipment trading enterprises in Florencia Municipality, Caquetá.

METHODS

Design: the methodological design used to reach our goals was the mixed (qualitative and quantitative), non-experimental, non-random approach for gathering information.

The process consisted in describing and characterizing variables in compliance with Decree 2242 as of 2015, Law 1819 as of 2016, the DIAN (National Tax and Customs Office) page and other sources of information contributing to the development of work.

Participants: the actors engaged in this research were 116 technology equipment trading business persons from Florencia Municipality. Particularly, the type of sampling carried out was the network or snowball, where some tradespersons performing electronic invoicing were identified, and they suggested other technology trading persons.

In this sense, these business persons were surveyed and afterwards, the results were analyzed through horizontal bar charts (see section Results) to characterize the sample.

On the other hand, two surveys were conducted: to a public accounting professional in Florencia City, who expressed his view regarding electronic invoicing processes, and to the director of DIAN in the section of Florencia – Caquetá, who answered the interview by using information and communication technologies. These results were tabulated via a cloud of words, thus making it possible to describe and qualify important factors of this piece of research.

Instruments: the survey was chosen as an instrument to do this research, considering that surveys make it possible to gather data on a specific matter. Surveys are conducted so that every surveyed person can answer the questions on an equal basis to avoid biased opinions that may influence the result of the piece of research.

On the other hand, the second instrument we used was the interview. Particularly, two interviews were conducted (with the same number of questions in order to develop a cloud of words and be able to obtain similar and differential clarifications) to gather specific data from experts in that area in Florencia Municipality – Caquetá. This instrument inquired about the importance of electronic invoicing and critical aspects that might result in barriers or bottleneck processes that do not allow an efficient process.

RESULTS

Importance, barriers and strategies of electronic invoicing in Florencia Municipality – Caquetá

According to the development of this piece of research, relevant results were obtained in connection with the study techniques used, where the interviews coincided in several aspects due to the questions; concerning this, a cloud of words was built, which is shown in figure 1.

Figure 1. Cloud of words, according to the interview

In the opinion of the interviewees, they define different advantages when implementing electronic invoicing in the small enterprises in Florencia Municipality.

- More control for the managers of the organization at the time of checking the information;

The truthfulness of the documents;

Reduction in possible sanctions in cases of inspection by the supervising entity;

Reduction in the cost of stationery.

Regarding the benefits above, it is evident that factor control predominates since it is one of the most important processes in the development of business activities, as it focuses on measuring the goals and implementing corrective action plans or measures to attain more efficiency and effectiveness.

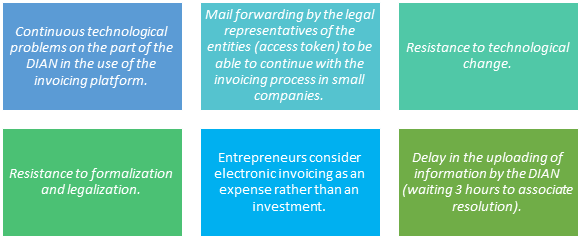

In this line of ideas, the interviewed mention and relate the problems recurring when implementing electronic invoicing in small technology trading enterprises (figure 2).

Figure 2. Problems when implementing electronic invoicing

It is here where the current technological problems and inconveniences are confirmed because of a lack of planning, trained human talent, economic resources and scarce implementation of strategies, making it possible to generate results in keeping with the goals of organizational growth and positioning. Likewise, one of the principles enunciated by Taylor(7) in his scientific management theory is confirmed, wherein resistance to change and to the new processes due to lack of real information is related. Real information would allow business persons to manage and adopt the new invoicing method.

In this sense, the interviewees mention the importance of having DIAN develop strategies so enterprises can comply with the requirements of the electronic invoicing process (figure 3).

Figure 3. Implementation of strategies by DIAN to promote electronic invoicing

Figure 3 shows different answers. Among them are requirements such as compulsoriness with the simple tax regime of issuing electronic invoices and, on the other hand, strategies that have enabled more enterprises to adopt the electronic invoicing method, such as customized accompaniment to entrepreneurs.

Concerning the recommendations for DIAN to improve action plans and strategies for implementing electronic invoicing, the interviewed explain that promoting enterprise culture is essential for acquiring this kind of technological processes and systematization, which are important to fulfil indicators and improve control. Among other recommendations, the interviewed remark: persuasion to formality, reduction in the set of tests and procedures for validation, an extension of the term of the digital certificate or unlimited digital certificate, reduction in processes when carrying out implementation, and enforcement of cost-reducing policies for technological operators when supplying registration packages.

Importance of electronic invoicing in technology trading enterprises

The survey that was conducted, the results are presented below, indicating the answers given by 116 technology-equipment-trading business persons in Florencia Municipality – Caquetá.

About the accounting processes developed in the enterprises of the tradespersons in the tertiary sector of the economy in Florencia Municipality, they state that electronic invoicing is a vital tool for the commercial development of their enterprises. Therefore, 78 business persons, in their opinion, have implemented this procedure in their enterprises. In turn, 22 business persons consider they do not currently need this kind of electronic invoicing process since they have not implemented it in their enterprises, and 16 business persons of this economic sector mention they are in the process of having this process included in their enterprises.

Technologies have become strategic tools and elements for the management and growth of enterprises in a globalized, post-pandemic environment, thus making it possible to generate higher efficiency rates. This is why, according to graph 2, 27 out of the 78 business persons who have implemented electronic invoicing have benefitted from this process as regards reduction in costs, while 25 business persons declare that, by way of electronic invoicing, they seek to reduce the scenarios of conflicts with their clients, thus preventing misunderstanding on unit costs and VAT tax. Next, 14 business persons expressed the importance of electronic invoicing through increased efficiency, a vital factor for the development of management and productivity and, from the viewpoint of the surveyed persons, the answer with less incidence was the quickness caused by electronic invoicing, where 12 business persons coincide with said opinion.

Figure 4 shows the distribution of frequencies concerning the recurrent problems facing business persons when implementing electronic invoicing, where 26 business persons state that the National Tax and Customs Office (DIAN) lacks training strategies, this answer being the one with more incidence. Following this, 25 business persons referred to the costs of implementing electronic invoicing in their enterprises, as specialized technologies and tools must be acquired to develop said process.

Of course, regarding the third answer with more incidence, this action is mentioned by Taylor (1908),(7) where the business persons referred to difficulties and resistance to the change of new processes, thus causing economic losses in the market.

In the opinion of the surveyed persons, the answer with less incidence is the lack of regulating knowledge of Resolution 42 as of May 5, 2020 (figure 4).

Figure 4. Recurrent problems of electronic invoicing

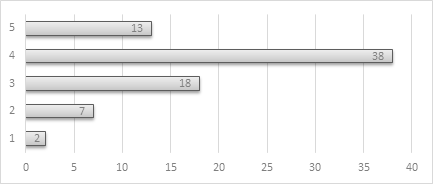

According to figure 5, a Likert scale was established, where 5 was the highest technological advance concerning the electronic invoicing process, and 1 was the lowest advance in said process. Concerning the criterion of the advance of the tradespersons in Florencia, 13 enterprises have attained the highest advance in this process, which, according to this category, have the appropriate technology to issue electronic invoices. Following this, 38 business persons state that their advance is currently type 4, i.e. their implementation has advanced, but they still have to do better in some aspects of the electronic invoicing process. Consequently, 18 business persons are at a medium level of implementation since their advance ranks 3.

Figure 5. Advance in the implementation of electronic invoicing in technology equipment trading enterprises in Florencia

Regarding seniority in implementing the electronic invoicing process, out of the 78 business persons implementing this kind of invoicing, some have more background in time and others, quite the reverse, an inferior advance in time. In this sense, concerning the trajectory and according to the opinion of 18 business persons, they have been implementing electronic invoicing for over one year, followed by 48 business persons who declared that their time of trajectory in implementing electronic invoicing ranges from 6 months to one year, and 12 business persons had spent less than 6 months implementing this procedure in their enterprise (figure 6).

Figure 6. Background to implementing electronic invoicing

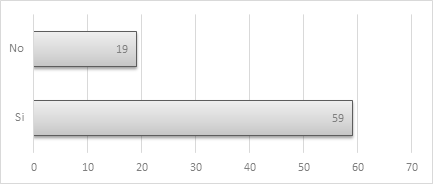

The knowledge business persons currently have of free solutions offered by DIAN to the electronic invoicing procedures is described in Figure 7. Our results indicate that 59 business persons know free access to the electronic invoicing software provided by DIAN, so its management and development in the interviewed enterprises is expected. On the other hand, 19 business persons affirm they do not know the said application. Here is where the business persons´ lack of training is confirmed (figure 3), who are unaware of the benefits granted by the National Tax and Customs Office (DIAN).

Figure 7. Knowledge of the free Electronic Invoicing solution provided by DIAN

Training courses are processes through which the collaborators or employees receive a brief induction about the development of an activity or process. They can generate experiences by implementing said practices. Here is where the importance of having HEIs (Higher Education Institutions) implement training in using the electronic invoicing platform provided by DIAN is born. Figure 8 shows that 3 persons answered positively about having received this kind of training from some university in their municipality. However, 73 business persons mention they have not received any training or practice from higher education institutions.

Figure 8. Training by the Higher Education Institutions in using the electronic invoicing platform provided by DIAN

Figure 9 illustrates the methods business persons use when developing electronic invoicing processes in their organizations. It can be seen that 62 business persons say they use software of their own to develop the electronic invoicing process in their enterprises. On the other hand, 11 business persons develop outsourcing processes via technological operators, and only 5 business persons use the free solutions provided by the National Tax and Customs Office (DIAN) to develop the electronic invoicing procedure.

Figure 9. Implemented electronic invoicing methods

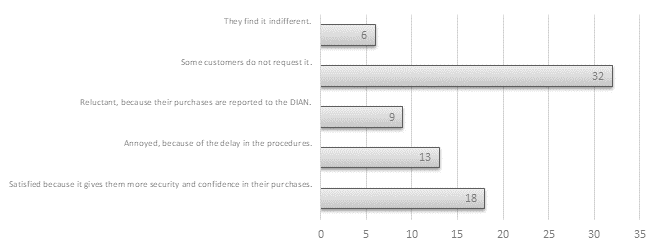

It should be emphasized that clients are the ones who generate the development and growth of enterprises; this is why it is important to analyze their stance on the processes of implementing electronic invoicing in the technology trading enterprises in Florencia Municipality. As shown in figure 10, 32 business persons declared that some of their clients request electronic invoicing; in turn, 18 business persons, in their opinion, indicated that their clients have expressed they are satisfied due to the safety and trust provided by that process when purchasing. However, 13 business persons stated that their clients said there were inconveniences due to the system's delay when issuing the electronic invoice, similar to 9 business persons who referred to the fact that clients were reluctant or upset because their purchases were reported to DIAN.

Figure 10. Reaction of clients to the implementation of electronic invoicing

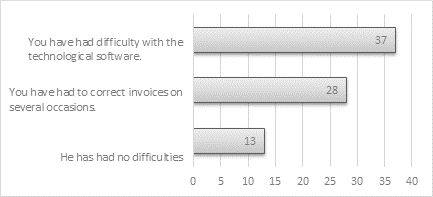

Nowadays, technological tools facilitate the development of procedures. According to the experience of the surveyed business persons in relation to the use of technologies to implement electronic invoicing, 37 of them declared they had had some difficulties with the technological software they currently have, and other 28 business persons, in their opinion, expressed they have adjusted or corrected electronic invoices several times due to alleged digitizing mistakes. Finally, 13 business persons affirmed they had no difficulty implementing said process and said it was a good experience as an electronic invoice issuer (figure 11).

Figure 11. Experience as an electronic invoice supplier issuer

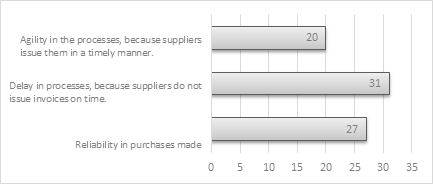

Concerning the experience of business persons when requesting electronic invoicing at the time of acquiring or buying a product and/or service, 31 business persons expressed their dissatisfaction when acquiring an invoice from other business persons since there have been delays in the processes because the suppliers do not issue the invoice on the acquisition of goods and services on time. Nevertheless, the position of 27 business persons is contrary to those above, as they trust the purchases they have made. The other 20 business persons describe the process as efficient and highlight the celerity of the processes because the suppliers issue them in due time.

Figure 12. Experience as a purchaser and receiver of the electronic invoice

DISCUSSION

DIAN is a special administrative unit for tax management. Its goal is to ensure and contribute to guaranteeing tax security in the Colombian State and, of course, watching over and protecting the public order as regards the economic aspect of that country, exerting administration and control in the fulfilment of the tax obligations and commitments of the private and public entities, where the General Comptrollership of the Nation, in turn, supervises DIAN.

In this sense, via Decree 2242 as of 2015, “which regulates the conditions for issuance and interoperability of the electronic invoice for mass extension and fiscal control”, DIAN implemented electronic invoicing to watch over its major goal and reduce the number of possible and/or potential tax evaders, thus enabling efficient control of the financial movements and liens of enterprises in Colombia. Under the framework of the criterion above, certain authors consider this measure appropriate due to better control and supervision in tax-related aspects.(8,9,10,11) However, other authors consider this measure has generated dissatisfaction and resistance due to the use of technology equipment, its high costs and the low level of knowledge and training of users to deal with electronic invoicing processes.(12,13)

According to Barreix et al.(14), it is important to stress that the implementation of electronic invoicing is a relatively new and efficient accounting process to improve the process of DIAN monitoring and following up the processes of selling and trading, payments and deliveries of economic resources carried out by enterprises. Said procedure is based on the principles of legality and transparency in the accounting and administrative processes.

For their part, Delerna et al.(15) indicate that information and communication technology immersed and integrated into accounting aspects of enterprises are valuable and fundamental, as they make it possible to relate multiple areas in a single system, avoiding the shortage of supplies or bottlenecks.

According to Montes and Carvajal(16), they comment that information and communication technologies pose a danger to the social development of enterprises, which is contrary to what has been proposed by Delerna et al.(15) Precisely they indicate that these tools seek to reduce the amount of human talent in the enterprises, thus generating a domino effect in other factors, such as unemployment, increase in the informality rates, among others.

CONCLUSIONS

According to the findings of our research, it is evident that information technologies move forward quickly, and enterprises are increasingly appropriating them. Therefore, we currently see them present at all business levels since they have passed from being an effective tool for big companies to become a need for any enterprise seeking a competitive advantage in the globalized market. Such is the case that they have become a fundamental tool in the business management of the management board, providing more information, efficient communication, flexibility and coordination in decision-making. Because of the above, the positive aspect they contribute is undeniable, in addition to increasing an organisation's competitiveness as a consequence of the improved internal and external processes.

Consequently, it is noticeable that the current state of the electronic invoicing process in the technology equipment trading and selling enterprises in Florencia Municipality is potentially high because business persons consider the competitive advantages and benefits generated by the implementation of said process in their enterprises. It is so that, during the development of this study, 78 business persons out of the 116 interviewed said they had implemented this procedure in their enterprises, evidencing different kinds of difficulties such as delays in the DIAN system for electronic invoicing, lack of training and use of technologies and, to a lesser extent, the costs of acquiring technology equipment to develop this process. Thus, it can be interpreted that the enterprise market of the tertiary sector dedicated to trading technology equipment has understood the importance and efficiency of using electronic invoicing.

Well now, the role of the Higher Education Institutions in this region is vital to the development of enterprises because, through said institutions, business persons train their personnel to achieve better productivity and efficiency indexes, which makes it possible to position the enterprise in the market. Therefore, Higher Education Institutions are a fundamental pillar for the National Tax and Customs Office since universities are scenarios of practice and experience, enabling the acquisition of theoretical and practical knowledge that, later on, will be applied in the production area.

REFERENCES

1. Kim E, Euh Y, Yoo J, Lee J, Jo Y, Lee D. Which business strategy improves ICT startup companies’ technical efficiency? Technology Analysis & Strategic Management 2021;33:843–56. https://doi.org/10.1080/09537325.2020.1849612.

2. Schwab K. World economic forum. Global Competitiveness Report (2014-2015) 2015.

3. Tran Thi Hoang G, Dupont L, Camargo M. Application of Decision-Making Methods in Smart City Projects: A Systematic Literature Review. Smart Cities 2019;2:433–52. https://doi.org/10.3390/smartcities2030027.

4. Hedelin L, Allwood CM. IT and strategic decision making. Industrial Management & Data Systems 2002;102:125–39. https://doi.org/10.1108/02635570210421318.

5. Ibarra D, Ganzarain J, Igartua JI. Business model innovation through Industry 4.0: A review. Procedia Manufacturing 2018;22:4–10. https://doi.org/10.1016/j.promfg.2018.03.002.

6. Ledesma F, González BEM. Patrones de comunicación científica sobre E-commerce: un estudio bibliométrico en la base de datos Scopus. Región Científica 2022;1:202213. https://doi.org/10.58763/rc202214.

7. Taylor H. The Science of Jurisprudence. Harvard Law Review 1909; 22:241–9. https://doi.org/10.2307/1323935.

8. Ruiz Castañeda M, Rojas García AA. Implementación del procesos de la facturación electrónica en Colombia en la Corporación en Salud (CES). Tesis de Grado. Tecnológico de Antioquia, 2020.

9. Márquez Polania M. Análisis de la factura electrónica como medio eficiente en el proceso de facturación para empresas de servicios temporales est. Tesis de Especialidad. Universidad Santo Tomás, 2021.

10. Fernández Bustamante PA, Meza Muñoz KM. El impacto del impuesto de renta dentro de la economía de las PyMEs de Colombia. Revista Colombiana de Contabilidad - ASFACOP. Revista Colombiana de Contabilidad 2019;7:97–110. https://doi.org/10.56241/asf.v7n13.121.

11. Sarmiento-Morales JJ. Identificación del impacto de la carga fiscal en las pyme de Bogotá, a partir del contexto latinoamericano, nacional y regional. Cuadernos de Contabilidad 2010;11:201–37.

12. Valderrama Ochoa ME, Moreno Quevedo R, Poveda Sánchez LD. Implementación de la facturación electrónica en Colombia. Tesis de Especialidad. Universidad Libre de Colombia, 2019.

13. Jiménez LSR. Dimensiones de emprendimiento: Relación educativa. El caso del programa cumbre. Región Científica 2022;1:202210. https://doi.org/10.58763/rc202210.

14. Barreix AD, Zambrano R, Costa MP, Bahia ÁA da S, Jesus EA de, Freitas VP de, et al. Factura electrónica en América Latina. Inter-American Development Bank; 2018.

15. Rios GED, Rodriguez DL. Importancia de las tecnologías de información en el fortalecimiento de competencias pedagógicas en tiempos de pandemia. Revista Científica de Sistemas e Informática 2021;1:69–78. https://doi.org/10.51252/rcsi.v1i1.104.

16. Morantes Manzano S, Carvajal Estupiñán MV. Implementación de la factura electrónica en Colombia a partir del decreto 2242 de 2015, en las MiPymes del barrio la merced de la ciudad de Cúcuta. Tesis de Especialidad. Universidad Libre de Colombia, 2018.

FINANCING

No financing.

CONFLICTS OF INTEREST

There are no conflicts of interest.

AUTHORSHIP CONTRIBUTION

Conceptualization: Disney Hernández Tique, Jenny Judith Puentes Ordoñez, Carlos Alberto Gómez Cano.

Data curation: Disney Hernández Tique, Jenny Judith Puentes Ordoñez, Carlos Alberto Gómez Cano.

Formal analysis: Disney Hernández Tique, Jenny Judith Puentes Ordoñez, Carlos Alberto Gómez Cano.

Research: Disney Hernández Tique, Jenny Judith Puentes Ordoñez, Carlos Alberto Gómez Cano.

Methodology: Disney Hernández Tique, Jenny Judith Puentes Ordoñez, Carlos Alberto Gómez Cano.

Writing - original draft: Disney Hernández Tique, Jenny Judith Puentes Ordoñez, Carlos Alberto Gómez Cano.

Writing - revision and editing: Disney Hernández Tique, Jenny Judith Puentes Ordoñez, Carlos Alberto Gómez Cano.